As 2018 ended, it’s the time where it can be analyzed the status of both the oil and gas sector as well as the chemicals sector. The oil and gas sector recovered, especially the oil markets from the depths of the post 2014 downturn. Since 2016, oil prices have recovered from $40, reaching $67 in Sep, 2018.

The recovery happened due to several factors. One of them is the success of the production restraint agreement between OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC countries, which is in force since the beginning of first half of 2017. Other factors that influenced the recovery of the oil and gas markets are the less oil coming to the market from challenged producers and the ongoing global demand growth estimated by the EIA.

EIA stands for Energy Information Administration, and the global demand growth for 2018 was estimated at 1.6 million b/d.

Oil and Gas Industry in 2019

In the latest Deloitte annual survey, they asked oil, gas and chemicals executives the following question:

As we move into 2019, what should we watch for? Does the recovery in oil markets have legs, or are emerging risks coming into play?

The questions resulted with a confidence in recovery, which results with high expectations for increased economic growth, commodity prices and investments overall. This is supported by the increase in energy demand above the average levels, as the US and global economy continue to display strong growth rate.

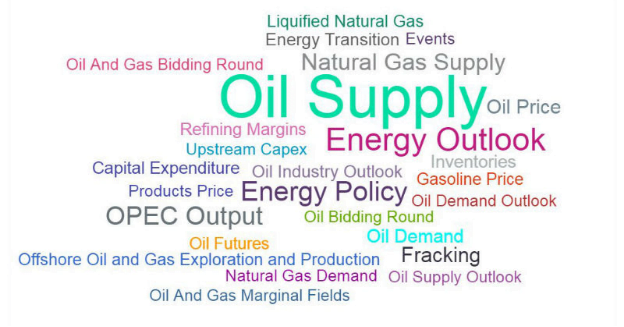

Below we can elaborate in more details the top 10 trends in the Oil and Gas Industry, presented by GlobalData researchers.

Oil and Gas Industry Trends in 2019

The top oil and gas industry trends of 2019, were identified by GlobalData researchers, and in their research they use data on online engagement, the number of mentions on Twitter, and different expert analysis.

The main trend in the Oil and Gas Industry to watch for in 2019, is the Oil and Gas supply. There are several problems, that will influence the Oil and Gas supply such as, the problems with Venezuela and Iran, as well as Qatar’s exit from OPEC.

The second trend to watch for is the Energy Outlook. In the past couple of years, the input of gas influencers online, industry whitepapers and journalism give a better and more realistic, expert overview of what is happening and future expectations in this sector.

Energy policies are the third trend listed in the GlobalData research, which includes the decisions, from the US Department of Energy and by other organizations as well. What will influence the oil production in 2019, is the rise of the federal oversight regarding the methane and wastewater, and the return of more autonomy to Oil-production parts in the United States. What can make the situation unpredictable, are the changes to the ranks of OPEC, especially in the part of how the countries manage their energy policies, as well as the political situation in the UK that can affect the policies related with the North Sea oil exploration and nuclear energy in Scotland.

Many are anticipating the Natural Gas supply to be at the forefront and expecting that in 2019, the global LNG (Liquefied Natural Gas) supply will outstrip demand, for few reasons. One is the development in China, of their own Natural Gas Infrastructure and the investments in LNG imports.

Next comes, the output of OPEC as a trend. As it has been stated in the beginning of this article, the OPEC has committed to pulling oil from the market. The reduction in oil production, still doesn’t scare many experts in the industry.

Other identified top trends are related with the Oil Price, Fracking, Oil Demand and inventories of oil, natural gas and goal. You can read more for these trends on the link.

Oil and Gas Supply Chain

The oil and gas global supply-chain includes activities such as domestic and international transportation, ordering and inventory visibility and control, materials handling, import/export facilitation and information technology.

Every Supply Chain in large industries involves configuration, management and continuous improvement of sequential set of operations that includes multiple parties. The goal in Supply Chain Management (SCM) is to deliver maximum service to the customer at the lowest cost possible.

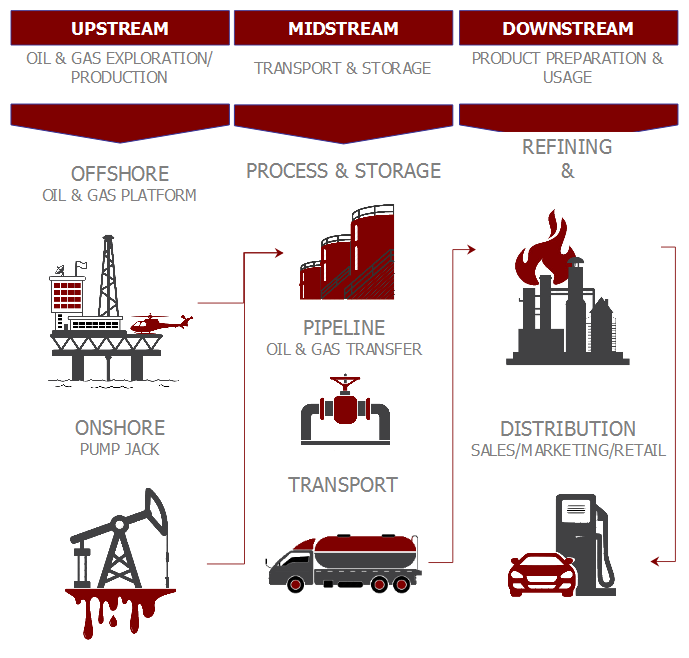

The Oil and Gas Supply Chain can be analyzed through three different industry sectors:

- Upstream

- Midstream

- Downstream

Oil & Gas Sectors. Image map created with iMindQ

Oil & Gas Sectors. Image map created with iMindQ

Upstream vs Midstream vs Downstream sector

When somebody wants to describe where a company or a service is in the Oil and Gas Supply chain, they usually use the generic business terms “Upstream” and “Downstream”. As companies or services get closer to servicing the end user, the more downstream they are located in the supply chain.

Each of these sectors have their own characteristics which will be elaborated in more details, further on in this article.

The upstream sector is also known as the E&P (Exploration and Production) sector. It is consisted of processes and operations that involve searching for potential underground or underwater crude oil and natural gas fields, drilling of exploratory wells, and subsequently drilling and operating the wells that recover and bring the crude oil and/or raw natural gas to the surface. In recent years, there is an evident shift towards the inclusion of unconventional gas as part of the Upstream sector. This also affects the developments in processing and transporting Liquefied Natural Gas (LNG).

The midstream sector is usually combined in the literature with the downstream sector. This segment in the supply chain, involves the transportation, storage and marketing of various oil and gas products. Transportation options can vary from small connector pipelines to massive cargo ships making trans-ocean crossings, depending on the commodity and distance covered.

When we are discussing the transportation of oil and natural gas, most oil can be transported in the current state, while the natural gas must be liquefied or compressed.

When it comes to the downstream sector, it encompasses the refining, processing, distillation and purification before turning it into usable, sell-able and consumable products e.g. fuels, raw chemicals and finished products etc. All the afore-mentioned services transform crude oil into usable products such as gasoline, fuel oils, and petroleum-based products. Retail marketing activities help move the finished products from energy companies to retailers or end users.

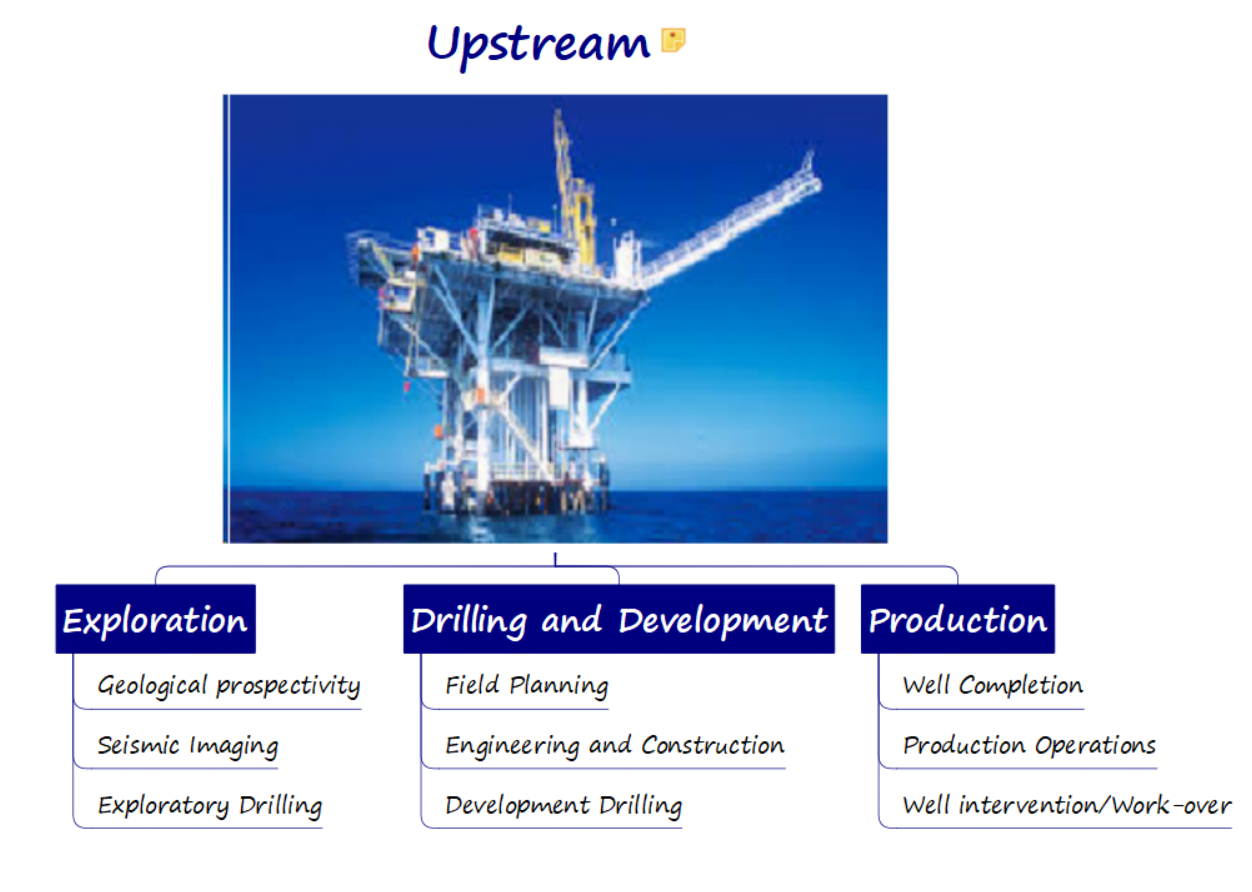

Upstream Oil and Gas Sector

“The Upstream sector is the part of the oil and natural gas industry that is responsible for finding crude oil and natural gas deposits, along with producing them. It is also known as the exploration and production or E&P sector. This part of the petroleum industry includes all activities that happen out in the field including drilling wells, trucking supplies, and mining oil sands, as well as activities that involve different environmental studies and research analysis.

Upstream Sector Characteristics

This segment of the oil and gas supply chain focuses and operates around the wells, meaning it cares about where to locate them, how deep and far to drill the wells, how to design, construct, and manage them.

The four major business characteristics that describe the upstream segment are as follows:

- Carries high risk

- Gives high return

- Highly regulated, it is affected by global politics

- Very technology and capital-intensive

The regulation of this segment, refers to the production, access to reserves, pricing & taxation, and more strict environmental regulations.

It is very typical for the upstream activities to take very long time, and require a lot of investments, especially in the initial, exploration phase.

The different sectors within the upstream segment include:

- Offshore drilling

- Oil sands mining

- Supply and service

- Manufacturing

- Seismic surveys

- Geological surveys

- Reclamation

Exploration, (Drilling) and Production (E&P)

The exploration phase first starts with activities of the operator to obtain a lease and permission to explore, from the owner of onshore or offshore acreage that might contain oil or gas.

This also includes activities of collecting geological, geophysical and geochemical material as well as different descriptions and maps of old mineral localities. Geologists and geophysicists play a major role in this phase, because they use different methods and techniques, such as seismic surveys, satellite images, magnetometers, air guns, explosives and seismometers, in order to assess the presence of hydrocarbons or minerals.

When the potential site is confirmed, the drilling of an exploratory well begins, process that is also known as drilling wild cat. These activities need to check the physical presence of reserves, so it can decided if additional exploratory wells should be drilled in close location. This way the scientists can confirm and evaluate the entire potential of the reservoir.

Production phase includes extraction of the hydrocarbons, separating the mixture of liquid hydrocarbons, gas, water, and solids, and removing of constituents that cannot be sold. The sites used for production can often handle crude oil from more than one well.

After production, an additional phase appears called abandonment, which happens when a well lacks the potential to produce economic quantities of oil or gas, or when a production well is no longer economically viable.

Upstream Sector Companies List and Categorization

There are four major groups of companies that can be identified in the upstream sector of the oil and gas supply chain:

- Majors, also known as Major or Integrated Oil companies, such as ExxonMobil, BP, Chevron and Shell. These companies can also have integrated activities down the supply chain as well.

- NOC’s (National Oil companies) who are owned and managed by governments,

- Independents – these companies exist in each segment, the independence comes from not being integrated into other segments.

- Oilfield services companies – These companies offer services, equipment and different technical skills related with exploring, drilling, testing, and producing oil and gas.

Midstream Oil and Gas Sector

Midstream segment in the oil and gas supply chain, includes operations that connect the upstream and downstream participants and companies. Four major groups of services are characteristic for the midstream segment are:

- Processing

- Storing

- Transporting

- Marketing

The more detailed services that fall within the midstream sector can be seen in this list:

- Diversified Midstream Pipeline and Storage

- Crude Oil and Refined Products Pipeline and Storage of Excess

- Marine Shipping and Transportation

- Natural Gas Gathering and Processing

- Natural Gas Pipeline and Storage

- Oil Field Services

The midstream segment is known for its low capital risk, and it can be highly regulated, especially when it comes to pipeline components. Other important things to know is that midstream asset investments are dependent on the health of the upstream; and oil and gas prices affect the demand from the downstream participants.

The high regulation mostly refers to interstate pipeline transmission and cross-border transportation. In the United States this is regulated by the Federal Energy Regulatory Commission.

Midstream Main Functions

Gathering, Processing and Transportation

First step in the midstream sector is gathering oil and gas that is produced in the upstream sector. Oil is moved through a web of pipeline, with a small diameter, directly to a central location. When it comes to gathering natural gas, the process is a little bit different, meaning the gas cannot be stored at or near the well and for that reason needs to be purified and processed to remove the water and other impurities. Once the NGL’s are separated, then they can be sent through large diameter pipelines.

Next comes the field processing, as the first phase of oil and gas processing starting in the onshore or offshore production field.

During field processing, surface units need to be installed. These facilities should do the following activities:

- Measure the production rate of the oil, gas and water that is produced from the reservoir

- Separate the oil, gas and water from one another

- Remove impurities to prepare the crude or gas for sale or the next process

- Store the Crude or gas temporarily, long enough until is ready to be moved to the next process

The above described process is known as fractionation. Fractionation by definition is the separation or removal process in which certain quantity of a mixture (gas, solid, liquid, enzymes, suspension or isotope) into a smaller quantities, called fractions, in which the composition varies.

The separated NGL’s (natural gas liquids) can be blend components in a refinery and used as fuel or feedstock in the manufacture of petrochemicals.

The treated oil and gas, after the fractionation process, should be transported through a complex network of transportation and distribution infrastructure either for storage or further processing.

When it comes to transporting crude oil, the most used and safest method is pipeline transportation. More flexible way of shipping crude oil is truck and rail, in terms of timing and close alternative locations.

For transporting natural gas, the most used method are large diameter pipelines, because natural gas flows at a much higher pressure than crude oil. LNG is natural gas that has been changed to a liquid form, so it can easier to transport it or store it.

After transportation, comes the storage as a step in the midstream activities. Storing crude oil and refined products is very different from the methods used to store natural gas.

Storing natural gas, is very demanding due to high pressure of the natural gas and for that reason is kept underground, until it is ready to be delivered to market. Common storage facilities are salt caverns, depleted gas reservoirs, and aquifers.

Crude oil and other refined products are stored using the following methods:

- Field tank batteries

- Product Bulk terminals

- Refinery and holding tanks.

Midstream Companies List – Key Players

In the 1980s, MLP started to form in the United States, known as Midstream Limited Partnerships. These companies, as you can see below are not the large oil companies. These companies provide specific service, and the service range of the companies can vary within the list below:

- Barge companies

- Railroad companies

- Trucking and hauling companies

- Pipeline transport companies

- Logistics and technology companies

- Transloading companies

- Terminal developers and operators

These are the top 10 midstream companies in 2018:

- OAO Transneft

- Enterprise Products Partners

- Plains All American

- TransCanada

- Kinder Morgan

- Spectra Energy

- Upltrapar Holdings

- Enbridge

- Oneok Partners

- Energy Transfer Equity

Downstream Oil and Gas Sector

The downstream sector is the last one in the oil and gas supply chain, and encapsulates the operations that take place after the production phase right to the point of sale to the end consumers. Here are included the processes of refining crude oil and distributing its byproducts (gasoline, NGL’s, diesel, jet fuel, heating oil etc.) up to the retail level and selling to end consumers.

Other products which are not that familiar are lubricants, synthetic rubber, plastics, fertilizers and pesticides. These products are called petrochemicals. The downstream sector has important role in the pharmaceutical, packaging and manufacturing industries.

Downstream Sector Characteristics

The main business characteristics about the downstream sector is that it is margin business, which has high complexity, companies should always have the global perspective in mind and it includes working with marketing and delivery of final products to retailers and end users.

When discussing about the downstream being a margin business, it defines the margin as the difference between the price of the products from the crude oil and the cost of the crude oil that is delivered to a refinery.

The complexity of this chain segments is due to the inclusion of different range of activities such as refining, petrochemicals, distribution, wholesale and retail marketing.

Key downstream sectors include:

- Oil Refining,

- Supply and Trading,

- Product Marketing – Wholesale and Retail

Key Downstream Players

There are two type of companies that compete in the downstream sector, known as integrated companies and independents. The companies that are called integrated, are known for having business operations not only in one specific sector, but are present in both upstream and downstream segments of the oil and gas supply chain.

One of the top integrated oil companies in the downstream sector are: Exxon Mobil, Chevron, BP, Shell, and Total.

There are also companies called independents, due to the fact that they don’t have upstream, E&P operations. These independents, are independent refiners which can have different range of service activities and stations to market their products.

Famous independent downstream companies are: Andeavor (formerly Tesoro), Valero Energy Corporation, Sunoco etc.

Refining, End user consumption and Wholesale and Retail Marketing

Refining represents the processes that enable crude oil compounds, called hydrocarbons, to be broken down and separated as byproducts, with the use of heat and pressure. The byproducts or final petroleum products that have resulted from the refining process can be categorized in three major categories: Light, medium and heavy.

The light group of the chemicals, are the first ones that evaporate and usually are lately processed into liquid petroleum or naphtha. Hydrocarbons from the middle category, also known as middle distillates-produce jet fuel and kerosene while the heaviest group of hydrocarbons, form residual fuel oil.

Gasoline is the most, globally-used product of crude oil. Other widely-known fuel products that consist for more than 60% of the global demand, are the following products: diesel, jet oil and marine fuel oil.

Also other type of products, for example lubricants and waxes, are important and used in other industries such as medicine and cosmetics.

The marketing activities in the downstream segment refer to the processes of promoting, searching and supplying customers who have internal demand for refined fuel products or who have large wholesale networks that can distribute the different product to variety of retailers.

Article by Mirjana Davcheva